According to a report by Knight Frank, Vietnam’s high-net-worth population stood at 15,132 in 2016. These high-net-worth individuals reportedly hold US$543 billion of the country’s wealth amongst them. The largest concentration of Vietnamese high-net-worth individuals are situated in the economic hub of Ho Chi Minh City which had around 5,900 millionaires in 2016.

In the ten-year period between 2007 and 2017, Vietnam experienced an astonishing 210% increase in its wealth. In light of this figure, it is not surprising that in the 2006-2016 period, Vietnam also saw a 320% increase in its high-net-worth population. Further exponential wealth growth is expected in the coming decade (200%), encouraged through the expansion in the local healthcare, manufacturing, and financial services sector. As wealth and the high-net-worth market in Vietnam expands, wealthy individuals, investors, and families, are expected to increasingly divert their attention to what the world has to offer outside their own country.

Vietnamese HNWI- Aspiration beyond migration

Vietnam is one of the 10 countries with the highest emigration rates in the Asia-Pacific, with an estimated 100,000 of its people emigrating each year. Not only that, but in the last five years leading to 2017, approximately 40,000 cases of resumption and relinquishment of Vietnamese nationality were reported from the Ministry of Justice to the State President. The US, Singapore, South Korea, Germany, France, Australia and Canada, have all been popular destinations for Vietnamese emigrants.

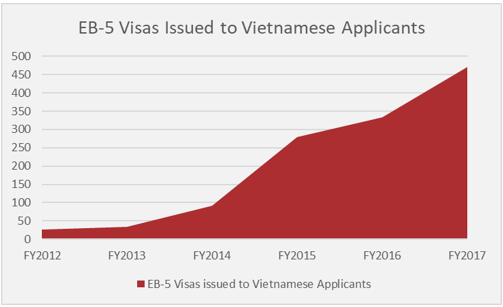

Vietnamese HNWIs, however, have the means to invest in programmes that facilitate the process or migrating and integrating within a new country. There has been a keen interest among Vietnamese in the US’ EB-5 immigrant investor program- Vietnamese applicants are now the second biggest nationality to be granted the visa. In fact, 471 EB-5 visas were granted to Vietnamese applicants in FY2017, following a steady yearly progression in interest and visa grants as shown below:

The US programme, however, has restrictive clauses for property investments, a reputation for waiting backlog, and maintains uncertainty among prospective applicants over the success of application. Attention has been slowly turning to more accessible European programmes, which offer various benefits and a relatively straight-forward procedure.

The Malta Individual Investment Programme and the Cyprus Investment Programme in particular could see a heightened appeal with Vietnamese HNWI since through an investment in either country’s economy, the individual could be granted dual citizenship and all the benefits it brings, including expansive visa-free access, advantageous business opportunities, a lavish Mediterranean lifestyle and exceptional education standards which are greatly sought after by the Vietnamese.

Restricted travel- the biggest driver

The people of Vietnam face considerable limitations exist when it comes to political and civil rights, including freedom of speech, opinion, association, and assembly. However, travel restrictions have played the biggest role in prompting Vietnamese HNWI to invest in residency or citizenship programmes.

Vietnam is one of the Southeast Asian countries which are most restrictive when it comes to global visa-free access. Unrestricted visa-free travel from Vietnam is only allowed when travelling to 51 countries, meaning all kinds of travel to the rest of the world face complications, since acquiring a visa is more often than not, a lengthy and tiresome procedure. For high-net-worth individuals in other countries it is inconceivable that they should have to go through so much trouble simply for travelling. This desire for facilitated travel has therefore played a monumental role in prompting Vietnamese HNWI to invest in residency or citizenship investment programmes.

The outward investment outlook in Vietnam

Notably, a number of obstacles also exist when conducting business in Vietnam. Infringement on intellectual property rights are a common deterrent to business in the country. Beyond bureaucracy and regular inspections by state management agencies, companies may also experience the challenges of corruption such as bribery and facilitation payments. It is for these reasons that local businesses are eager to relocate or invest in more favourable jurisdictions.

Over the first seven months of 2018 alone, Vietnamese businesses diverted US$238.33 million in 81 new ventures abroad and an additional US$41.3 million into 21 existing overseas projects. According to the Foreign Investment Agency, the greatest investment was geared towards the finance and banking sectors, followed by the agro-forestry-fishery sector and the processing and manufacturing industry. Top destinations among the Vietnamese investors include Laos, Australia, Slovakia, Cambodia, Cuba, and Myanmar. Naturally, as more Vietnamese HNWI look into investing abroad, investment in immigrant investor programmes will also become more commonplace.